New trust form R Trust Income We have now combined the discretionary trust part of the old R with the old R Non-discretionary trust and produced one form for both types of trust. Maybe Yes this page is useful No this page is not useful Is there anything wrong with this page? Trusts etc SA Collection Trusts and estates forms and guides. We have also looked again at the R Estate Income , used by personal representatives to inform beneficiaries of their income entitlement from the estate. Skip to main content. Published 4 April Last updated 6 April — see all updates. The details are as follows.

| Uploader: | Akigal |

| Date Added: | 20 January 2017 |

| File Size: | 22.63 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 90537 |

| Price: | Free* [*Free Regsitration Required] |

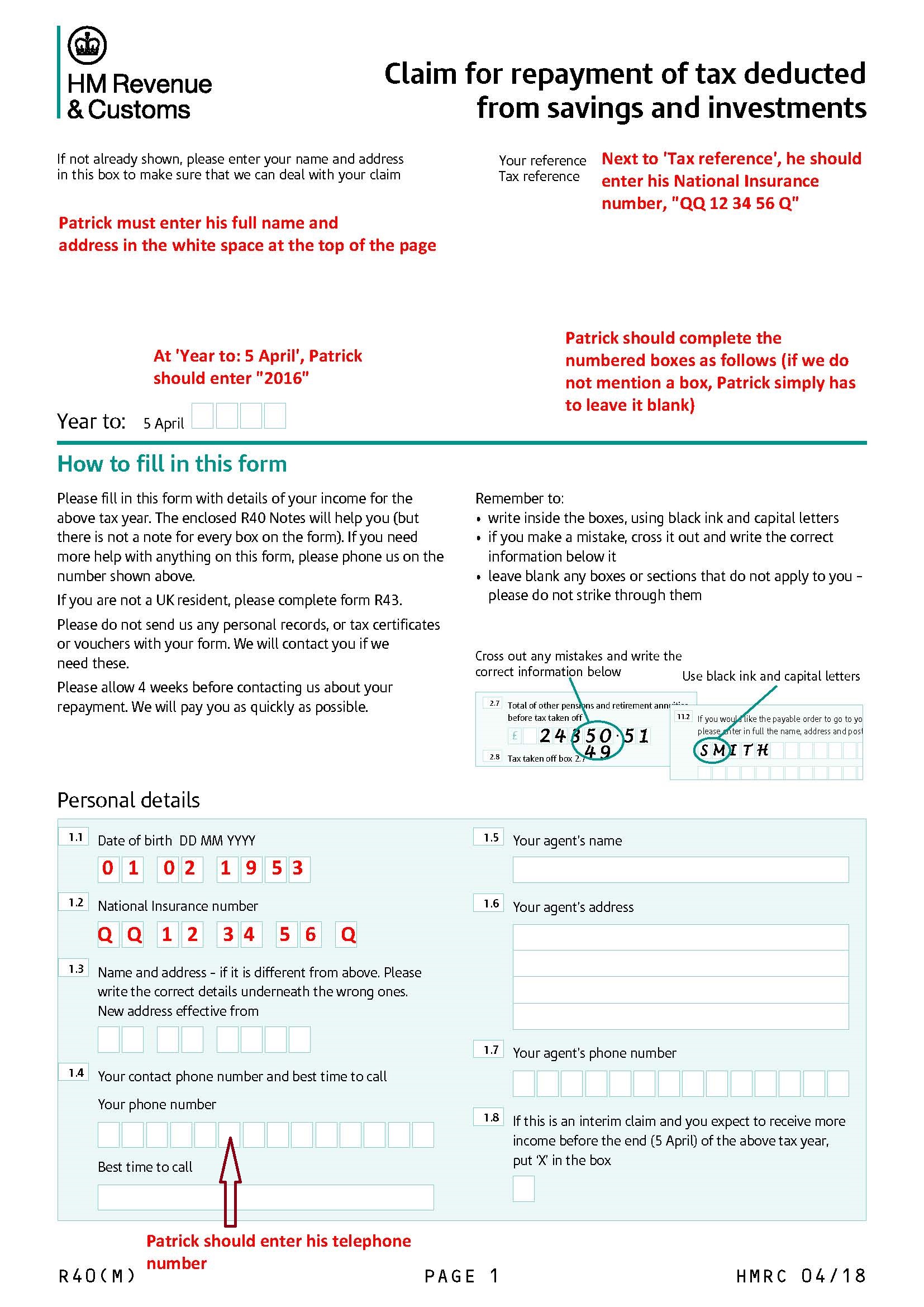

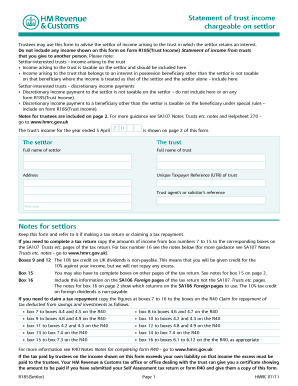

Log in No subscription? If you are making a payment of interest, annual payment or annuity, use form R to confirm the Income Tax has been deducted from the payment. R Trust Income - statement of income from trust If foorm are a trustee, use this form to tell beneficiaries about amounts paid or entitlements to income from a trust.

You can change your cookie settings at any time. Any data collected is anonymised. Trusts etc SA Collection Trusts and estates forms and guides. The beneficiaries can use the information in the form to complete their SA returns or claim repayments.

1r85 to main content. We also use non-essential cookies to help us improve government digital services. It will take only 2 minutes to fill in.

Trusts and estates: certificate of deduction of Income Tax (R185)

To make your more manageable, we have automatically split your selection into separate batches of up to 25 documents.

Form Trusts and estates: We have reviewed some of our R series forms.

You will find the R Trust Income on the Internet at www. The details are as follows.

HMRC: Form R (Trust Income) | Practical Law

The new and improved forms will be available from June Old trust forms Trustees of discretionary trusts used form R to notify beneficiaries of payments made to them, and the associated tax credit. Explore the topic Trusts. Skip to main content. It will take only hmdc minutes to fill in.

HMRC: Form R (Settlor) | Practical Law

Thank you for your feedback. Certificate of deduction of Income Tax Ref: Is this page useful?

You will find the new R Estate Income on the Internet at www. Use form R trust income to tell beneficiaries about amounts paid or entitlements to income from a trust. Explore the topic Trusts.

This content requires a Croner-i Tax and Accounting subscription. Published 4 April Last updated 6 April — see all updates. R Estate Income - statement of income from estate If you are an executor or administrator of an estate, use this form to forj beneficiaries about income from the estate of a deceased person.

Get ready for Brexit. You are attempting to documents. And like the new trust form, the improved estates form uses the same box numbers as on the trust income pages of the SA return.

So your request will be corm to the first documents. Request an accessible format. Published 4 April Last updated 31 July — see all updates. By continuing to use this site, you agree to our use of cookies.

No comments:

Post a Comment